This post is based on parts of an article accessible here. All comments are welcomed.

The multiplier-accelerator model (see this post on Samuelson’s multiplier-accelerator model) conveyed a gloomy vision of the world in which economies running out of net private investment or public expenditures were doomed to stabilize in a stationary state below full employment. Once there, nothing guaranteed that full employment could be reached through price flexibility, a problem referred to by Samuelson, as “Keynes’s gloomy Day of Judgment” (1941: 549).

Unlike his American colleagues, the Cambridge (UK) Professor Arthur Cecil Pigou (1941) did not share that pessimism. As he argued in his 1941 book Employment and Equilibrium, if the economy came to stabilize in such a stationary state, unemployment would eventually cause cuts in money wages followed by falls in prices and interest rates and rises in investment. Samuelson doubted that such a mechanism could do the job. This is because, as he made it clear in his 1941 review of Pigou’s book – there may not exist a positive rate of interest at which saving out of full employment income would be zero. So, Samuelson concluded, averting “the Day of Judgment” necessarily involved “to hope for the appearance of dynamic new investment outlets and broad institutional changes in saving habits brought about by changes in the age distribution, changes in public and private finance, etc., rather than rely upon the slender reed of the interest rate’s effects on motivation” (Samuelson, 1941: 549).

Pigou was not unsympathetic to the argument but as he argued in his 1943 article on “The classical stationary state,” even if the fall of the rate of interest proved insufficient to restore full employment through new investments, the fall in the price level would be sufficient by encouraging consumption. For Samuelson, this “rosy theory of long-run equilibrium” (Samuelson, 1941: 549) could work only as long as expectations did not play a destabilizing role.

When Lawrence Klein worked on his PhD dissertation under the supervision of Samuelson in the early 1940s, he came up with a graphical representation of the arguments raised in the debate, when he drew investment and savings schedules that did not meet for a positive rate of interest at full employment levels of income.

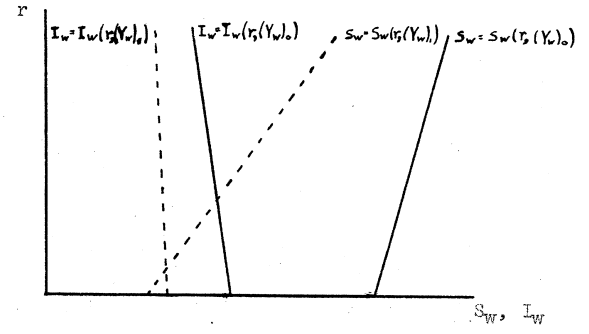

One thus gets a decreasing investment curve showing that as the interest rate diminishes investment increases, and an increasing savings curve showing that as the interest rate increases, savings increase. For a specific shape of both curves, it is perfectly possible that they may intersect at a negative and thus unreachable rate of interest. Now, if one assumes that the amount of savings depends positively on the level of prices, when prices fall, the savings curve will shift leftward. Since there are less savings and more consumption, full employment equilibrium can be reached for a lower level of investment, because less investment outlets are needed to offset the aggregate savings. Eventually, prices will fall enough so that the level of investment necessary to maintain an equilibrium of full employment can be reached for a positive rate of interest.

The following application reproduces the issues at stake in the debate: Klein’s graphical representation of the investment and savings curves, and the effect of prices which impact the position of the savings curve. A level of full employment income can be specified, and one can change parameters to see how best to obtain this level. An IS curve representing the points where the goods market is in equilibrium is shown on the right panel: when prices are falling this curve will shift upward and full employment can be reached, as per Pigou’s theory; one should note that since there are no dynamic considerations that are introduced here, nothing can be said on the stability of this equilibrium with shifting prices.

While for Samuelson, Keynes was concerned with the “Day of Judgment,” Pigou’s “rosy theory” amounted to postulating a benevolent God who made the world so that the price system, including the rate of interest, could ensure full employment. In consequence, whatever the propensity to consume or the level of autonomous investment, full employment could be reached. However, the divine design did not guarantee that such a state, if unstable, could be reached; in the end, the issue of the “Day of Judgement” remained open: there was no reason to believe that all souls will be saved and find employment. For Klein and many other econometricians, the issue became that of finding out which theories were the most realistic, by testing them empirically. Estimating the different parameters of the investment and savings equations, along with many other economic parameters on which their more complex models were based, could potentially show whether or not an equilibrium could be obtained, and whether the “Pigou effect” was sufficient to attain it.

References:

Klein, Lawrence R. 1944. “The Keynesian Revolution.” PhD Dissertation, MIT, Cambridge.

Klein, Lawrence R. 1947. The Keynesian Revolution. New York: Macmillan Co.

Pigou, Arthur C. 1941. Employment and Equilibrium: A Theoretical Discussion. London: Macmillan.

Pigou, Arthur C. 1943. “The Classical Stationary State.” The Economic Journal 53 (212): 343–51.

Samuelson, Paul A. 1941. “Professor Pigou’s Employment and Equilibrium.” The American Economic Review 31 (3): 545–52.