Part I of the book is focused on the first models of the cycle developed by the econometricians. The main questions they were trying to answer were: how to account for the persistence of fluctuations? What mechanisms were best suited to explain those fluctuations? How stable was the economy? Was it converging toward a point of equilibrium?

The first (European) meetings of the Econometric Society were mainly devoted to clearing out the mathematical and economic issues surrounding those questions. While Frisch’s 1933 article, “Propagation problems and impulse problems in dynamic economics” is often viewed as the point of departure and reference of these reflections, we argue that they were in fact already being discussed intensively and that progress had been made since at least 1931, and the first meeting in Lausanne (Switzerland).

Essential to this progress was Jan Tinbergen, who built several models on a very small scale, often only of a market rather than the whole economy: Tinbergen himself referenced Frisch’s seminal paper more often as the point of departure of a reflection on macroeconomics rather than a reflection on dynamic economics, a subject on which Tinbergen was the most versatile pioneer. His many models and their variants seeking to explain economic trajectories gave way to a more unified vision in the “purchasing power” model, first published in 1934. The purchasing power model became itself a building block for his 1935 model, that distinguished clearly between two sectors of production (investment and consumption), a result of the discussions of the preceding years.

Although Tinbergen (and Frisch to a lesser extent) were the main mathematical inspirations for other econometricians, it is apparent from the exchanges in the meetings and the evolution of Tinbergen’s models that Kalecki was the most influential when it came to economic theory and mechanisms. While the model he presented in the 1933 meeting used a mathematical solution presented by Tinbergen in Lausanne, it also brought to the foreground of macrodynamic research the mechanisms relying on the changes in profits, investment and consumption, anticipating many of the developments that became mainstream after Keynes.

This first part brings back to life how the interactions of these economists laid the foundations for much of the subsequent work in macroeconomics and the analysis of economic policy. Attention will also be paid to the limits and critics of this new approach, in particular the idea that the cycle was just a “myth”, defended by Irving Fisher.

Macrodynamics in wonderland: the race for profits in Kalecki (1933)

Macrodynamics in wonderland: the race for profits in Kalecki (1933) A micro foundational episode of the early history of macroeconomics: Jan Tinbergen’s first step toward multiple equilibria and coordination failures

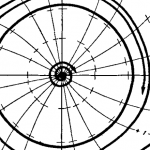

A micro foundational episode of the early history of macroeconomics: Jan Tinbergen’s first step toward multiple equilibria and coordination failures Coming (almost) full circle: Relaxation oscillations in the early development of econometrics (1929-1951)

Coming (almost) full circle: Relaxation oscillations in the early development of econometrics (1929-1951) Tinbergen (1936): A nonlinear model of collapse

Tinbergen (1936): A nonlinear model of collapse